The Simply Budgets

Program |

|

|

David Wright: Founder of Simply Budgets. |

The Amazingly Simple |

Watch the Simply Budgets Slide Show and discover the simple money management system you should have been taught in school!

|

|

Let me tell you a bit more about the life-changing money management system I stumbled onto, perfected, and then had someone who knows how to write computer software professionally convert from a bunch of spreadsheets I had created into the very efficient software package now available from this web-site. Firstly let me say this, if you are looking for a money management system for tediously keeping computerised financial records, you are at the wrong place! (Maybe you should go and look at the Quicken, Microsoft Money or similar web-sites.) I meet people all the time who think that religiously recording where they spent their money in the past is going to help make their financial future work out for the better. I hate to burst your bubble if you are one of these people, but I can tell you that over the years I have spent hundreds of hours writing down where every cent went, and all that ever did for me was fill my ceiling with folders full of financial history! Nothing ever got better, I just had a record of how bad things were in the past. Maybe you know what I'm talking about! I even sat down regularly and wrote down how much I was spending on all the things in my budget and proved our family budget should work. The problem was, it really wasn't working! If you are looking for a new, more effective and less time consuming money management system, that does not require for you to continuously enter where your money was spent, you are in the right place. The best and simplest way I can describe what I am talking about in the paragraphs above is like this. When you drive your car down the road, do you find it easier to steer by watching in the rear-vision mirror, or is looking through the windscreen more effective? Hopefully this silly question makes it really obvious about the point I want you to understand. You need a money management system that allows you to see where your finances are heading. One that allows you to plan a successful path through the maze of bills and other expenses that lie ahead. Keeping records is all very well if you need to do it for tax reasons, but I'm sure you have better things to do with your time, especially if there is a better way to take control of your finances once and for all. You see, almost everyone experiences money problems at some time or other. If you haven't already asked yourself why this is so, then let me save you all the time and stress that I went through to learn what we all should have been taught earlier in our lives. It seemed a bit odd to me that nobody sets out to have money problems on purpose, but almost everyone seems to have them anyway! In fact most people wish for a better financial situation every day, but it just doesn't happen! I got to thinking, "Are we all so stupid that we get it so wrong?". I came to the conclusion there was one common reason that nobody had really focused on before and when I started looking into it, I realised that I had stumbled onto an important discovery. Over the following few years I put all my energy into exploring and developing this idea. The exciting thing was that I was getting results. We changed from a family who constantly experienced difficulty paying our bills, to a family where bills no longer caused any concern to us at all. (No more fear of the postman!) Not only that, we began to see savings growing in our bank account! I was so pleased with what I had discovered that I just couldn't keep it to myself. I wanted to share it with anyone who would listen to me.I started going into people's homes to give them a free demonstration of how my money management system worked. Every one I showed was so impressed they wanted me to use my system on them as well and things just grew from there! It’s now quite a few years since then and I have continued to improve and develop what is now called Simply Budgets. It’s a computer based money management system and thousands of people have made the decision to take a new look at their personal finances using this system. Many have contacted me saying how much it has helped them. Take a look at the Testimonials page on this web site to see the sorts of things people have said. I would be absolutely amazed if you can't also benefit from what I have discovered. The concept is so simple you will wonder why you didn't think of it yourself! The good news is that you won't need to spend a few years developing the system like I did. You can get your finances heading in the right direction straight away!Be warned though, you will need to be prepared to look at your family budget in a totally different way than you have in the past. So, how does it work? Well, traditional budgeting systems require you to set ‘target’ amounts for each of your expenses and then, as time passes, you recorded ‘actual’ amounts beside those targets. Not only is this a slow and tedious process, the fact that most people continue to have financial difficulty when using a money management system like this suggested to me that there must be a better way of managing a budget. What I realized was that although I regularly received Bank Statements, these did not help me. My bank statements were recording a history I did not like but was unable to change because it had already happened. Bank statements look backwards! I could see I needed to look forwards! The problem was that at the bottom of each Bank Statement was a ‘Closing Balance’. This told me how much money I had in my account. What I wanted to know was how much spare money I had, but my statement never told me that. Consequently I had to have a bit of a guess as to whether I could afford to do some of the things I wanted to do or not. This just wasn't good enough and all too often I would spend money only to find out later that there was an expense coming up that I would not be able to pay. At other times I would say “no” to some of the things I wanted to do when I really could afford to do them but I just wasn't sure. It became obvious that I didn't have the information I needed to get it right. Imagine how good it would be if your bank manager would send you a cheque every time a known bill was due. The note attached might read, “Dear John, I see your Phone Bill is due next week. Here is $150 so you can pay it” Of course your bank manager will not do this for you, but in essence this is what Simply Budgets allows you to do for yourself. What it does is simple! It prepares your perfect bank statement for the next year in advance showing you exactly where your finances need to be up to every day along the way. All you have to do is follow the numbers. Not only that, you can easily identify any spare money you have available to spend on yourself. No more money accidents or guess work! Right now you don't know how much money you should have in the bank. That makes it really easy to get it wrong. Once you do know, it is so much easier to get it right! I hope this is making sense, because it really annoys most people when they suddenly realise they have been struggling along for years with their finances and suddenly they have found the missing piece of the puzzle! Let me explain a little about how Simply Budgets does what it does. It gets you to place your expenses into three logical groups:-

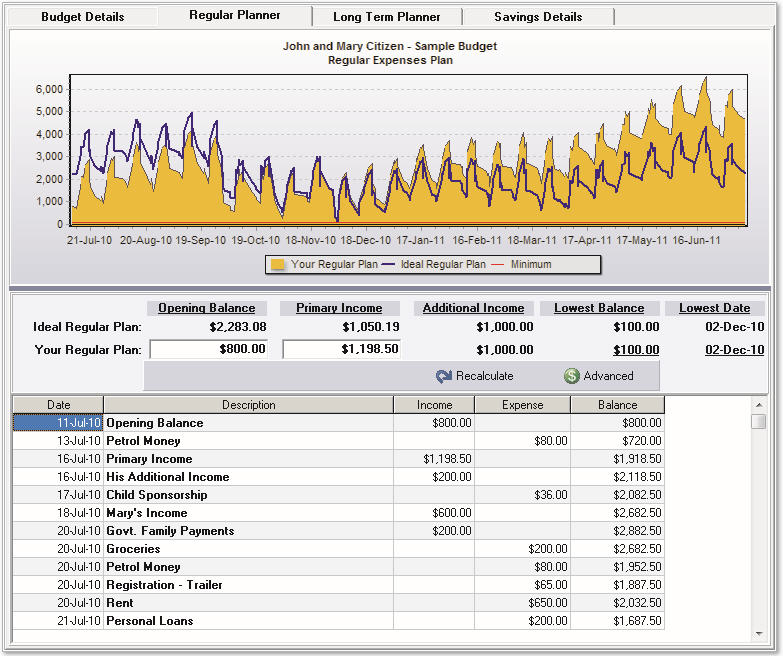

At the press of a button the computer calculates a plan that shows how to meet all of these expenses for the next year in advance. It factors in all of the “ups” and “downs” of your bank balance and makes sure money is available at the time it is needed for all of the bills and activities you budgeted for. All you then have to do is check from time to time to make sure you stay on or above the path you have planned.

The budget shows your “Bank Statement in Advance” for the next year. It shows all of your scheduled transactions in order with the running balances that you need to target in order to budget successfully. Having this information made such a difference in our finances it was astounding. Now I want you to have the benefits as well, but I realise this is possibly the very first time you have ever heard about Simply Budgets. I know I would be very cautious before believing something that sounds too good to be true that I just found on the internet. (Especially when it relates to money). Let me invite you to get to know more about the Simply Budgets system and the secrets I have discovered about money management over the past ten years. You can do this by taking me up on my offer of a free subscription to my Money Hints and Tips newsletter. In these newsletters I explain exactly how the system works. I'll even tell you how you can use my money management system without ever paying me a cent (am I crazy?) and as an added incentive, I am offering a free gift when you receive the first newsletter just to let you know I am serious about wanting to help you. Scroll up this page and on the left you will find a simple form to fill in. All that is required is your name and e-mail address to access hundreds of dollars worth of powerful information for free! Some of the features built into my software include: Printable Budget Calendars, Savings Planner, Income/Expenses report and graph, printable reports for long and short term expenses, Credit Card management and more.............

|

|

|

Watch the Simply Budgets Video * As broadcast on Television |

Contact Us - Finance Professionals