- But their laughter turned to Amazement when they saw my Kids In Action!"

Introducing a Revolutionary New Way to Teach Your Kids How to Create Wealth and Build a Solid Financial Future.

|

Order Pocket Pal Now. |

Let's face it. Each week we're hit with a never ending stream of bills that make it increasingly difficult for us to get ahead financially. And because we often struggle to make ends meet, the opportunity to teach our children how to get ahead in financially life is slimmer than ever.

It's great that the simplicity of the Simply Budgets Program and the diversity of the Cash Flow Clinic will show you how to erase your own money worries forever....

....But what about your children?

Should they be left to themselves to also learn the shattering hard lessons that you had to learn? What about the pain? Should they be left to deal with financial institutions, loan managers and credit sharks - and then learn from their own mistakes? Just like we did!

Simply put, running a financially successful family today is getting harder than ever unless you discover the secrets for easily, efficiently and affordably controlling your budget and cash flow. Then you've got to teach it to your kids!

So What's The Secret? In a Nutshell, it's simply this:

Your Future or the Future of Your Children.

Yes, it's true... Today the world changes at such a rapid pace that new developments make it literally impossible for your child to have the same education that you and I had. Nor can they have the same life experiences. And while this is scary at times for a parent, we live in a time where limitless possibilities truly are available to one and all.

Let me give you an example:

Have you ever heard or said this, "If I had known then what I know now... I would never have ... (you fill in the blank)"?

As a parent myself I must have thought this countless times.

The reason is that by the time I was 25 years old I had already accumulated tens of thousands of dollars in debt. Just to make things worse, I didn't own a car, I didn't have a house and I didn't have any savings. In fact - I had nothing to show for my 5 years of full time income at all.

"If I had known then what I know now, I would Never have let that happen!"

This debt philosophy of mine stayed with me for the next seven years. The one thing that my parents did not teach me was how to manage my money effectively. It's not because they didn't want to, it's not because they didn't love me - it's because they Didn't Know How!

So I'd like to assure that right now - I will not repeat that same situation with my own children.

The Question is - how about you?

and Build a Solid Financial Future for Themselves and their Families.

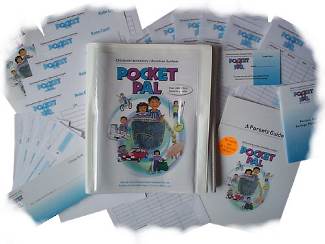

Pocket Pal has all the tools your child will need to learn about working for an income, taxation, income protection insurance, budgeting, balancing a cheque book, saving and credit card debt.

Pocket Pal has already proven to thousands of Australian families that children *really can learn how* to budget and control their finances, all they need are the tools. Pocket Pal offers you (and them) a complete system with all the tools required in a simple, easy-to-learn-and-use format.

But don't take my word for it, here's what children from all over the country are saying about this unique money management system:

|

I know you're probably still skeptical and a bit on the conservative side, but think about this - if your children learn the wrong things, and keep doing those things over and over again - they'll only succeed in getting the same results as you or I would.

(Sort of makes you think, "Been There - Done That." Right?)

Wrong. Dead Wrong. Just because we've been there and so often made mistakes, does not mean that our children should learn the same way.

It's a fact that every day our children come into contact with money, it could be their lunch money, the bus fare or their pocket money. Every day we easily miss the opportunity to educate our children about the number one language in the world – money.

Children today are faced with a very different adult world than the one we as parents faced. Internet banking, plastic transactions, enterprise bargaining, Internet shopping, buy now pay later, mobile phone accounts and easy credit.

Here is your chance to give your child a very healthy start to adulthood. You can give them the start that so many of us as adults never had. How many times have you heard ‘I wish I was taught that when I was a child’.

Pocket Pal is an amazing collection of every day money tools that we as adults take for granted. Your child will get to play, interact and practice using the very tools that millions of Australian adults do not know how to use.

They will have the wisdom of a 40 year old at the age of 14. Your child will know and use the secrets of financial wealth.

They will learn - through their own efforts - to live within their means.

They will know and use a budget. They will have experience at an early age and under the guidance of Mum or Dad, the dangers of credit card debt.

We try to teach our children as much as we can. We try to prepare them for the day they leave home. Imagine your child if they were worldly at 18 with the knowledge of work ethics, taxation, income protection, budgeting, savings and credit card use. With Pocket Pal your child will have a dynamic start to life. They will learn how to rise up and meet their potential head on - with Success as their reward.

Millionaires are not made from the size of their income but by how the income is managed. Give your child every possible start in life by letting them use Pocket Pal – The Complete Children’s Pocket Money Management System.

Here's What You Get with your Pocket Pal:

|

Pocket Pal Rate Card You as the parent become the employer and complete a rate card listing all jobs than can be done for a set amount of money – pocket money. Put this on the fridge. Work out how much you want to pay each week in total then allocate an amount to each job so they all add up to that amount. |

|

Pocket Pal Job Card Your child completes these jobs daily and enters them onto the job card, it is here that they pay tax to the parents of 10% on their income The total amount at the end of the week is where you as Taxman deduct 10% in Tax. |

|

Pocket Pal Insurance Policy When your child begins, they complete the income protection policy and pay 5% of their income to Mum and Dad. If at any time they are unable to do their jobs in one week due to sickness or accident than the parents will pay them what they earned the previous week. The insurance contract allows you to be the first person that your child has a contract with. One day they will sign a real contract and remember your words - read before you sign. |

|

Pocket Pal Cheque Book Each week your child’s income (Pocket money for jobs completed) is transferred into their own cheque book with you (Mum or Dad) being the bank. Here they learn to budget and balance their money. When they wish to buy something they give you (the bank) a cheque for the amount they want. If you choose to do Pocket Pal on a Sunday then they can learn to make the money will last all week. Do Pocket Pal on a Friday then they learn to make it last just the weekend. |

|

Pocket Pal Savings Book Save first spend later: We need to teach our children to save 10% of everything they earn. Doing this through out their life will give them the very best habits for financial independence. The savings book is used every pay day. The best money habit we can give to our children is to save 10% of everything they earn or receive. That includes Birthday money or Christmas money. |

|

Pocket Pal Credit Card Once bitten twice shy: One day your child will have a credit card. What they learn to do with it however, is up to you. Let them use one now with Pocket Pal and learn that they can bite. Credit is wonderful if you control it and not it controls you. Every child will use a credit card one day. It is best for them to use one when Mum and Dad are their bank managers. |

|

Pocket Pal Parents Guide This is your comprehensive step by step guide showing you as the parent how to get the most from Pocket Pal. It includes:

|

Just Imagine what kind of differences in life your children will experience if they are given the opportunity to start putting these strategies into practice now, rather than later. They'll be able to learn without the pressures of the world bearing down on them. How much more money, savings and happiness will that mean to them?

However, the Great News for you is this: There's no need to reinvent the wheel. Everything is ready for you, absolutely turn-keyed, and all laid-out in simple step-by-step utilities.

In summary, Pocket Pal is a tremendous value-for-money package.

So Your Next Question is, "What's All This Going To Cost Me?"

Instead of thinking cost, you should consider investment. Investment in your child's future. Investment towards preparing and setting them up for life - literally.

If we were going to charge you by an hourly rate according to the dozens upon dozens of hours it's taken to create, perfect and fine-tune Pocket Pal; or if you were to try and replicate the system yourself, at bare bones minimum you'd be looking at $400 - $500.

But, that of course seems ridiculous. We're not going to charge you $400, $500 or even $100, the apparent going rate for any kind of money management system these days (which don't even give you a quarter of the tool's Pocket Pal has for you)!

As part of a limited time Joint Venture between Pocket Pal and Simply Budgets, your total investment is only $49.50!

But remember, you must take action before it's too late. If you set this aside--chances are too great you'll forget about it.

There is no better time than right now to begin teaching and training your children to develop the Wealth Mentality.

It's possible you know. And if it is ever going to happen, YOU as their parent will play a significant role.

Order Pocket Pal kit Today, you'll be so happy that you did (and so will your Children).

Warm Regards,

David, and the Team at Simply Budgets.

One Question, and many answers:

(Q) I have two children, how many Pocket Pals do I need.

(A) You will need one Pocket Pal per child. Each Pocket Pal contains the necessary tools for one child, eg; One Credit Card, one Cheque Book.

What Does the Press and Public Think about Pocket Pal?

Twice Pocket Pal has appeared in Australia’s most respected money magazine PERSONAL INVESTOR with comments like ‘The Pocket Pal system is part game, but it’s carried out with real world seriousness’.

When your child becomes an adult one of the first people they will meet is the bank manager, have you ever met a bank manager that asks for your school report card before giving you a loan. Here is your chance to give your child a head start in life.

Pocket Pal has proven to thousands of Australian families that children really can learn how to budget and control their finances, all they need is the tools. Pocket Pal is a complete system that gives you these tools in a handsome carry case.

Introduce your child to the real world of money management while you take on the role of employer, tax collector, insurance company and bank manager all the while being their Mum and Dad. Now there could not be a softer approach than having your parents as your first introduction to money.

Appearing on ‘A Current Affair’ the question was asked ‘ It’s not part of the school curriculum, so who will teach our children the secrets to financial success’. The answer was given as Pocket Pal.

Regardless of your child’s school results they must become financially savvy. What would your child’s financial report card look like. Will the first credit card your child uses be a real one?. Does your child know how to balance their income against their expenses?. Have you explained to your child that they have to read a contract before signing it?

One day your child will be performing each of these duties with out you being present.

| At last here is a money game that has captured my daughter's attention. Called Pocket Pal, it provides her with her own credit card, cheque book, savings book, rate and job card. - Susan Hely, August 2000 | |

| Most of us know that starting early is the key to achieving financial success. It's hard to think of a better investment. Noel Whittaker - November 2001 | |

|

Appearing on ‘A Current Affair’ the question was asked ‘ It’s not part of the school curriculum, so who will teach our children the secrets to financial success’. The answer was given as Pocket Pal. - January 2000 |

|

"... an innovative concept designed to make competent money managers of Australia's "forgotten population" children. - February 2002 |

Home - The Program - Testimonials - Questions - Order Now - Contact Us

Finance Professionals Click Here

Template Design by:

A+ Templates

Copyright � 2006 Simply Budgets. Com. All rights

reserved. Privacy Policy.